We’re powering cross-border payments for digital marketplaces worldwide.

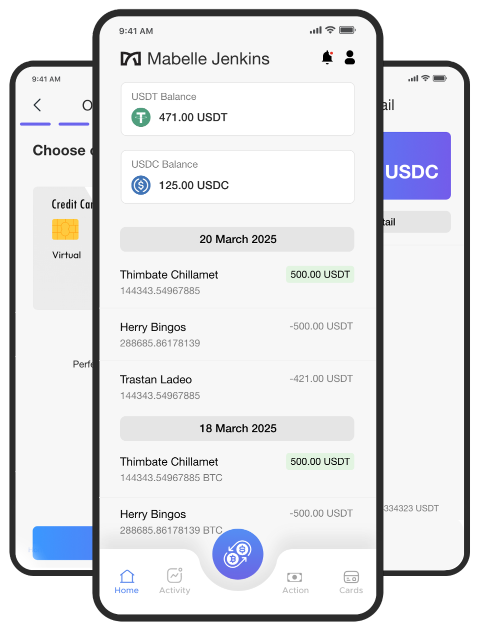

Grow your business beyond borders by accepting card payments and receiving instant payouts. Memo eliminates banking delays and simplifies international transactions. With just a link, you can reach customers anywhere and get paid in USDT or USDC.

Memo makes international payments simple by letting businesses accept card payments and receive USDT/ USDC without delays or complications

Create and share invoices or payment links in seconds. Whether you’re selling products or offering services, MEMO makes it easy to request payments from anywhere in the world—no coding, no confusion.

Your customers can pay using any major credit or debit card, regardless of their location. MEMO handles the complexity so you get paid fast, safely, and in a currency that retains its value.

Receive payments in USDc or USDT, directly in your MEMO wallet. Easily withdraw to your crypto wallet at any time. No banking delays, no currency devaluation—just financial freedom.

Accept payments from anywhere in the world—no local banking infrastructure required.

Let your clients pay via Visa, MasterCard, and other major debit/credit cards with ease.

No waiting for bank clearances. Funds are available in your MEMO wallet instantly after payment.

Now you can use your USDT with the convenience of a card, online or in-store. Memo Cards let you shop, pay, and withdraw just like a traditional bank card — but powered by crypto.

Memo is a global payment processor. It allows businesses to accept credit and debit card payments from anywhere in the world and receive the funds in cryptocurrency like USDT/ USDC. It is ideal for freelancers, service providers, and global businesses. Payments arrive faster, and you stay in full control of your funds.

1000+ businesses rely on Memo to power cross-border payments every day

Meets all relevant US financial, AML, KYC, SEC, and FinCEN regulations

Send payments & withdraw crypto 24/7, 365 days a year, from anywhere

Trusted by users worldwide for seamless, secure transactions and unmatched convenience. Swipe right to see why our clients choose Memo to power their biggest ambitions.

“ I’ve been using Memo for a few months, and it has completely transformed the way I handle my crypto transactions. The app is super easy to use, with low fees and instant transfers. It’s perfect for anyone looking for a hassle-free ”

Juan L., Digital Marketer

As a freelance designer in Argentina, receiving payments used to be stressful and slow. With MEMO, I send a link, and my client pays with a card. I receive stablecoins instantly—it’s fast, reliable, and I’m finally in control of my money.

Camila R., Freelance Designer

I run an online store in Kenya selling custom electronics. MEMO made it easy for me to accept payments from customers in the U.S. and Europe. No more blocked transfers or crazy fees—just smooth transactions and instant access to funds.

Daniel M., E-commerce Owner

MEMO is a modern global payment processing platform that allows individuals and businesses to receive payments via debit or credit cards and instantly convert those funds into cryptocurrency (such as USDT, USDC).

With MEMO, users can:

Unlike traditional processors, MEMO bridges the gap between fiat and crypto, offering a fast, secure, and borderless solution for freelancers, digital sellers, startups, and remote professionals.

MEMO is designed for both individuals and businesses globally. Whether you’re a freelancer, digital product seller, service provider, or an international business, MEMO helps you receive payments in a fast, secure, and borderless manner.

Users can receive payments in USD via credit or debit cards. The funds are automatically converted and settled in stablecoins such as USDT, USDC, or Bitcoin (BTC) depending on your selected preferences.

Yes, to comply with international anti-money laundering (AML) and Know Your Customer (KYC) regulations, you may be required to verify your identity. This could include submitting an ID document and a selfie. KYC is mandatory for users who wish to withdraw funds or exceed basic usage limits.

No. Customers only need to enter their card details to complete the payment. They are not required to register or complete KYC. This ensures a frictionless payment experience for your buyers.

MEMO applies a transaction fee, which includes:

We will clearly show you the final fee before every transaction.

In most cases, the crypto is delivered to your wallet within seconds after the customer’s payment is approved. However, some transactions may take up to a few minutes depending on the network load or additional checks.

Yes. You can withdraw your USDT, USDC, or BTC from your MEMO wallet to any external crypto wallet address you control. Network fees will apply based on blockchain usage.

Absolutely. MEMO uses bank-level encryption, SSL protocols, and third-party security audits to protect your data and transactions. All sensitive payment data is processed via PCI-compliant partners like Stripe and Coinbase.

We are working on plugins and APIs that will allow direct MEMO integration into e-commerce platforms and custom websites. For now, you can use payment links generated via the app to collect payments easily from anywhere.